A year in review: Top trends

influencing the OTA industry

2024 was another strong year for OTAs. With the global tourism sector recovering to 98% of pre-pandemic levels, leading OTAs grew at a slower pace compared to the previous year but still reported notable results. During the first three quarters of 2024:

- Booking Holdings reported a total revenue of $22 billion, a 9% year-over-year increase.

- Expedia reported about half the revenue of Booking Holdings, with a year-over-year growth of approximately 6%.

- Airbnb achieved the strongest growth, at 12%, totaling approximately $7.5 billion.

- Tripadvisor’s revenue remained flat, but its Viator brand grew by 10%.

In Europe, the OTA market share went from 19.7% to 29.6% between 2013 and 2023. In the United States, they accounted for 21% of booking revenue, totaling $100 billion.

But numbers only tell part of the story. 2024 was also a year of strategic partnerships, acquisitions, and innovation as OTAs—both large and small—adapted to changing traveler expectations.

Below are five key trends from 2024 and their potential impact on independent hotels in 2025.

1. OTAs are breaking the bank with marketing

OTAs are ramping up marketing investments to secure market share and drive top-of-funnel activity. In 2024, the four largest OTAs—Expedia Group, Booking Holdings, Airbnb, and Trip.com Group—spent $17.8 billion on sales and marketing, up 1 billion from 2023.

Higher marketing budgets reflect OTAs’ commitment to capturing online bookings, projected to reach 65% of global market by 2026. Much of this spending goes to Google, which is both ad publisher and competitor through Google Hotels. Travel companies have long complained about Google’s dominance, with CEOs from TripAdvisor and Expedia Group openly criticizing it for redirecting search traffic towards its own travel businesses.

In 2024, a U.S. District Judge found Google guilty of maintaining a search monopoly. While this decision could potentially favor other search engines like Bing and DuckDuckGo in the long term, it’s unlikely to have any effect in the medium and short term, as legal battles of this magnitude often take years to produce tangible outcomes.

What this means for hotels

Increased OTA visibility through marketing benefits hotels but can also deepen their reliance on OTAs and raise commission costs. Hotels must balance their distribution strategy with OTAs and direct channels, exploring alternative strategies like email campaigns, partnerships with tourism boards, and loyalty programs to boost direct bookings.

2. Forging new alliances and making big moves

In 2024, OTAs actively pursued alliances, partnerships, and acquisitions to build loyalty and improve guest experiences. Key moves include:

1. Agoda—a Singapore-based OTA and a subsidiary of Booking Holdings—teamed up with South Korean low-cost airline Jeju Air to offer exclusive rates on its platform.

2. Viator integrated its catalog of local travel experiences into Amazon’s Alexa Smart Properties, allowing travelers at participating properties to explore and book activities via Echo Show devices.

3. Expedia partnered with Microsoft to allow Bing Travel users to earn both Microsoft Rewards and Expedia points.

4. Ixigo— an Indian OTA focused on flights, hotels, trains, and buses—acquired train food delivery platform Zoop.

5. Indian OTA MakeMyTrip acquired Happay, a travel expense management software, to strengthen its B2B segment.

6. Latin American OTA Despegar renegotiated its partnership with Expedia Group, gaining more freedom to source its hotel inventory outside Latin America.

7. Dutch tech investment firm Prosus acquired Despegar to integrate its offerings with other verticals, including e-commerce and food delivery.

These initiatives focus on cross-selling and simplifying travel planning. This trend was highlighted during Booking Holdings’ Q3 earnings call, which noted significant growth in multi-vertical transactions, particularly travelers booking flights after reserving accommodations.

What this means for hotels

The increasing integration of technology into travel is raising guest expectations. Independent hotels can stay competitive by adopting tools that simplify booking, enhance in-room technology, and improve payment processes.

3. Asia is (still) ramping up

Many of the initiatives mentioned earlier involved Asian OTAs, and that’s no coincidence. Asia remains a key growth market for travel, despite its slower post-pandemic recovery due to prolonged restrictions. The region’s expanding middle class is increasingly relying on OTAs for trip planning and bookings.

India is a standout market. While China’s outbound travel recovery remains gradual—by Q3 2024, outbound travel reached 82% of 2019 figures, with substantial growth in the Asia-Pacific region- India’s outbound travel is projected to grow at a 7.4% annual rate through 2033.

A 2024 Expedia Group survey highlighted the preferences of Asian travelers, such as:

- Faster adoption of mobile and social technologies

- Long trips (8-14 days) with short hotel stays across multiple destinations

- A preference for luxury travel experiences and amenities such as complimentary transportation, bottled water, and toothbrushes.

What this means for hotels

Hotels that aim to target this segment should keep up with studies on Asian travelers’ expectations and adapt their offerings. Amenities such as transportation services or complimentary in-room essentials can make a big difference. With nearly 30% of Asian travelers still booking through traditional means, partnering with local travel agencies could be an effective way for hotels to connect with this audience and diversify booking channels.

4. OTAs go all-in on AI-powered travel planning

The way travelers plan trips has been transformed thanks to artificial intelligence. OTAs have been quick to go all-in – converting traditional chatbots into advanced AI-powered travel consultants.

Several OTAs are leading the charge with innovative solutions. Booking.com’s Smart Filter is a tool that lets users describe their ideal property in their own words, removing the need for manual filtering. Landfolk’s Daisy combines text and visual search, making it easier to find holiday homes that match specific preferences.

Trip.com Group’s TripGen chatbot not only delivers real-time travel routes and itineraries but also provides booking advice to keep plans seamless. And Expedia Group launched Romie which offers tailored suggestions for restaurants and itineraries and can coordinate group trips by joining SMS group chats to understand participants’ preferences.

What this means for hotels

OTAs’ AI-powered tools that match travelers with tailored accommodations can help hotels—especially those with a unique offering—connect with the right audience more effectively.

At the same time, these developments are making technology an integral part of the travel experience. To meet the expectations of tech-savvy guests, independent hotels should consider AI-based innovations such as personalized communications and tailored in-stay recommendations.

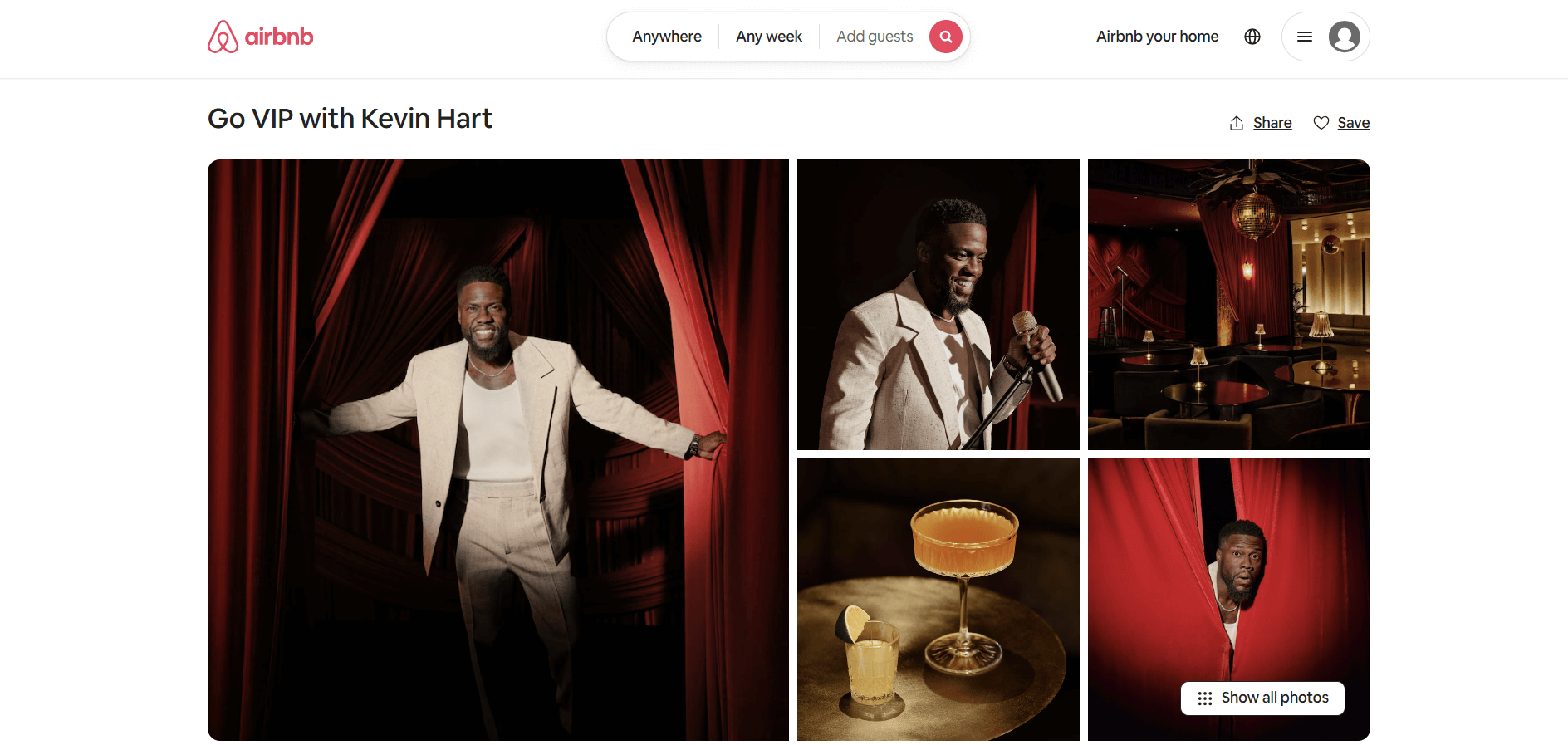

5. VIP vibes: Celebs take center stage on OTAs

To differentiate their offerings, OTAs are turning to celebrities and influencers. Recent examples include Ludacris becoming Booking.com’s host, joining other A-list celebrities like Mariah Carey and Martha Stewart.

@bookingcom You can book a 2-night stay at one of Luda’s ATL homes for you and 3 friends. You can’t book Luda though. Or can you… The listing goes live on 8/28 at noon ET for just $4.04, so you gotta be quick! @Ludacris ♬ original sound – Booking.com

Airbnb launched Icons, a category of exclusive experiences that includes the Musée d’Orsay’s clock room in Paris, Prince’s Purple Rain house in Minneapolis, and Kevin Hart’s members-only speakeasy in LA.

Brian Chesky, CEO of Airbnb is just getting started with this strategy. He told financial analysts, “We still think we can have even more unique inventory that you can only find at Airbnb, that’s not on another platform, and we want to recruit some of the most interesting people in the world to be on our platform, and we’re getting a lot of excitement.”

While these experiences are limited (often being constantly sold out or unavailable), they generate media attention, encourage bookings, and boost loyalty by associating platforms with memorable experiences.

What this means for hotels

As with the previous trend, any initiative that is good for OTAs is also good for hotels, at least as long as that doesn’t increase their reliance. To tap into travelers’ demand for unique experiences, hotels can try and replicate these strategies on a smaller scale, by offering curated experiences that stand out as authentic, or by partnering with local influencers.