Hotels can’t afford rearview forecasting. Smarter models capture what’s coming, not just what’s been, so teams stay ahead of demand shifts.

Forecasting has always been one of the hardest parts of running a hotel. You’re trying to answer questions about the future with data from the past, all while the market moves faster than ever.

Done well, demand forecasting helps revenue leaders understand how many guests are coming, who they are, and what’s driving them. That informs everything from rate strategy to staffing, budgeting, and even which guests you target with marketing.

Done poorly, it turns into guesswork, missed opportunities, and “How did we sell out at the wrong rate again?”

In this article, we’ll explore how forecasting is changing – and how tools like Cloudbeds Revenue Intelligence help you move from being reactive to truly predictive.

What is hotel demand forecasting?

Hotel demand forecasting is the practice of predicting future room nights, revenue, and guest mix over different time horizons (short, medium, and long term).

It combines:

- Historical hotel performance data (past bookings, ADR, RevPAR, seasonality)

- Live booking signals (pickup, pace, cancellations, channel mix)

- External and forward-looking data (competitor rates, events, search demand, OTA visibility, market trends, market conditions, economic conditions)

The goal is simple: sell the right hotel room, to the right guest, at the right time and price, while giving every department a clearer view of what’s coming for optimal decision-making.

How forecasting is done today

Here’s a typical revenue management scenario in the hospitality industry built on traditional forecasting methods.

A hotel knows that the first week of July is usually busy thanks to a local jazz festival. Last year, it saw a spike in demand and raised room rates modestly. This year, the team expects something similar and plans rates using last year’s performance as the benchmark.

What’s changed?

- The festival has moved to a larger venue

- The lineup features higher-profile musicians

- Marketing has expanded, attracting market segments from further afield

In reality, demand is much stronger than last year.

With a modern forecasting model, the hotel would see this early: rising lead times, higher competitor rates, and a stronger pickup curve than expected. It could:

- Raise rates earlier and more aggressively

- Hold back some inventory and release it closer to stay dates

- Layer in smart upsell offers and direct booking campaigns

With a traditional model, that surge in future demand only becomes obvious once it’s already happening. By then, many rooms are already sold at suboptimal rates – leaving revenue on the table.

During Passport, Amit Popat, Head of Machine Learning at Cloudbeds, broke down some of the key challenges of traditional forecasting today.

The best forecasting models out there are often only hitting 80–85% accuracy, because they’re just using a snapshot of your data. They’re not looking at the full context.

Unsubscribe from uncertainty.

Learn how Cloudbeds Revenue Intelligence provides up to 95% forecast accuracy.

Where traditional hotel forecasting falls short

Two core limitations of traditional forecasting lead to those missed opportunities.

1. Rates & bookings are disconnected

In standard demand models, rates and bookings are often managed in silos.

The pricing system looks at historical data sources and simple rules (“If occupancy is X, do Y”), while the forecast itself is just a static projection. It doesn’t continuously evolve as the booking window unfolds.

The result?

- Slow reaction to demand fluctuations

- Forecasts that jump from “plan” to “final outcome” with little nuance in between

- Missed chances to optimize because the system doesn’t “see” the story developing in real time

Back to our festival example: by the time the forecast is updated and someone notices that this year is pacing well ahead of last year, too many rooms are already locked in at last year’s prices.

2. Little to no external or forward-looking data

Traditional models also struggle to ingest and interpret the data you already have access to, such as:

- Compset rates and availability

- Your hotel’s OTA ranking and visibility

- Search traffic and demand from partners

- External factors like local events and demand drivers

This is all forward-looking signals. It tells you how strong demand might be before bookings actually arrive.

Most hotels know this data exists; they simply don’t have a way to process it at scale or plug it into a unified forecasting framework. So revenue managers are forced to fill the gaps with gut feel and spreadsheets.

The result is biased predictions, missed opportunities, and profitability that could have been captured with a clearer forward view.

We’re speaking to countless general managers and revenue managers. They’re spending so much time firefighting that they don’t have time for that high-level strategic outlook.

How other industries forecast demand

Other industries have already moved beyond these limitations.

They use machine learning and causal AI to build models that adapt to new conditions and learn from every new data point. For example:

Airlines analyze booking pace, seasonality, historical demand, competitor pricing, and customer behavior to predict demand levels at various points in time before departure. If demand for a flight is forecasted to be high during peak season, dynamic models may set higher initial prices.

As the departure date nears, the models continuously update pricing strategies based on current booking trends and competitors’ prices, raising or lowering rates to maximize revenue.

Online retailers like Amazon use forecasting algorithms that analyze historical purchase patterns and real-time data, such as seasonal demand, competitor prices, and current stock levels, to adjust product prices and inventory.

For instance, if there’s a surge in demand for a popular toy, the forecasting system immediately updates projections, prompting the company to increase stock levels or adjust prices accordingly.

Similarly, Uber’s AI-powered predictive model continuously analyzes factors like traffic, weather, time of day, and historical demand patterns to forecast where demand will spike in specific areas.

When demand for rides in an area exceeds the number of available drivers, Uber’s algorithm increases rates to encourage more drivers to move to that location and balance supply and demand.

The common thread?

They’re not just looking at what happened last year. They’re synthesizing countless signals about what’s happening right now, and what’s likely to happen next.

The evolution of hotel demand forecasting

The hotel industry has historically lagged behind these industries. Not because the opportunity isn’t there, but because the tech and data pipelines were missing.

That’s changing fast.

Hotels sit on incredibly rich datasets. A study published in Tourism Management highlighted just how much nuance is hidden inside booking curves alone.

The study analyzed booking data of U.S. hotels using dynamic mathematical models and found that guests booking for a Monday or a Wednesday stay are likely to make their reservations closer to the arrival date, with a noticeable increase in bookings in the last few days. Additionally, guests booking for a Wednesday typically reserve slightly earlier than those booking for a Monday.

With this insight, hotel managers might keep Monday rates steady or slightly lower early in the booking window to encourage early reservations, then raise them closer to the stay date to capture last-minute demand. Conversely, for Wednesday bookings, it could be more effective to increase rates slightly earlier in the booking window and adjust them less aggressively closer to the stay date to attract more last-minute bookings.

These powerful insights add up and can have a significant impact when dynamically incorporated into a hotel’s revenue management strategy. The more accurate forecasts a hotel can proactively prepare, the more total revenue it will generate.

Causal AI for hotels is here

Advanced forecasting is no longer aspirational. It’s live in hotels today.

Revenue management systems like Cloudbeds Revenue Intelligence, powered by our Signals AI foundation model, use causal AI and machine learning to bring together:

- Booking patterns and pickup from Cloudbeds PMS

- External data like compset rates, OTA rankings, and special event data

- Forward-looking search and demand signals from trusted partners

All of it is processed in a single mathematical framework, and – crucially – Cloudbeds trains an individual model per property.

That allows the model to learn what actually drives revenue performance for your hotel business, not just “hotels in general.”

With causal AI, hotels can:

- Spot weak demand early. Predict when market rates are trending down so you can sell more rooms earlier and avoid big last-minute discounts.

- Capitalize on demand spikes. Identify when rates should rise and hold back inventory to release closer to stay dates at higher prices.

- Undercut strategically. Determine when and by how much to undercut competitors to win bookings without racing to the bottom.

We’re processing over four billion hospitality data points per hour, and we’re seeing up to 95% forecast accuracy over a three-month window – even 97% for some properties.

Traditional models often top out around 80–85% accuracy. That 10–15 point gap is the difference between “good enough” and genuinely game-changing.

The impact of causal AI: Beyond theory

Causal AI is transforming revenue management forecasting for hotels in multiple ways, including:

Boosting occupancy

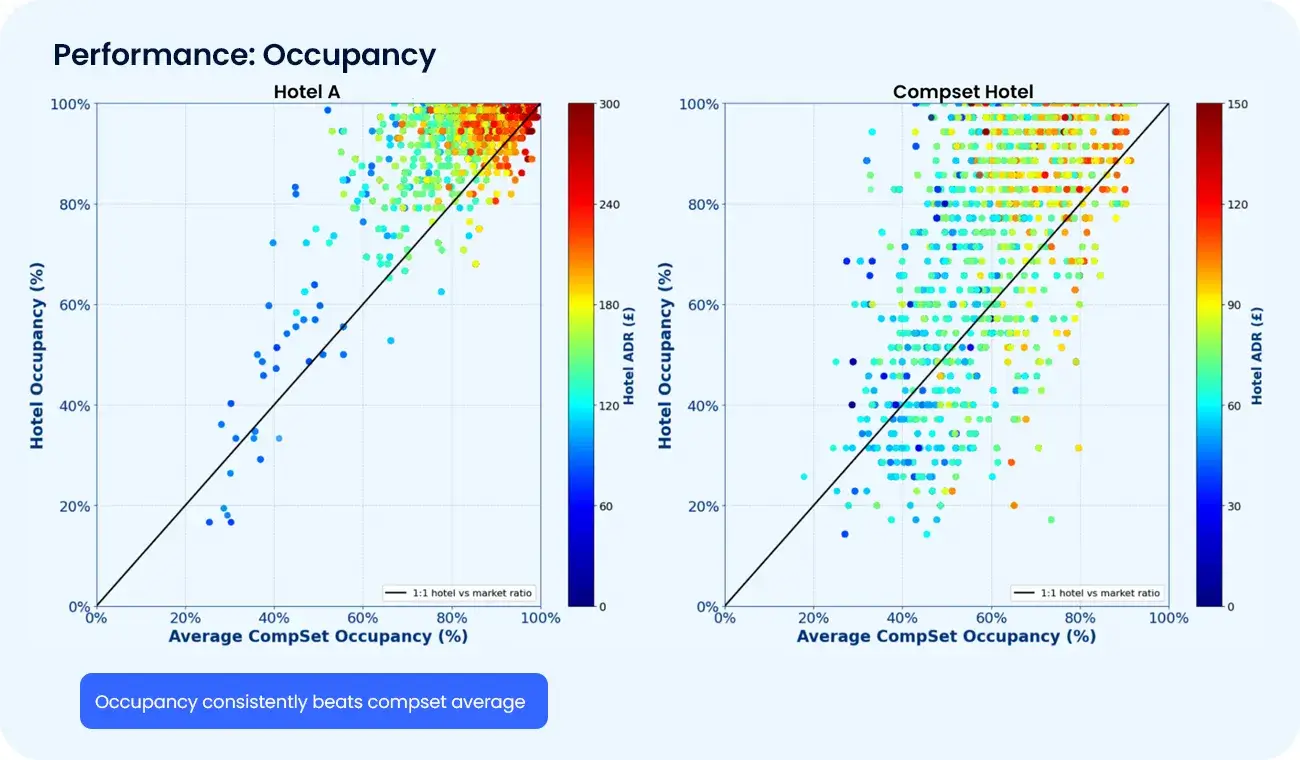

To understand the impact of causal AI, let’s examine the charts below, which compare a hotel using the Cloudbeds model (left panel, Hotel A) to a competitor using traditional forecasting (right panel, Hotel B).

The bold line represents the average occupancy rate for the competitive set. Each point on the chart shows a specific day’s occupancy for the hotel. Points above the line indicate days when the hotel’s occupancy outperforms the compset average, while points below the line indicate low demand. Colors represent different ADRs (average daily rates), with red and orange indicating higher ones and blue indicating lower ones. (Note that Hotel A’s scale is double that of Hotel B.)

In the left chart, the points are clustered in the upper right section, above the bold line, meaning that Hotel A frequently achieves higher occupancy than its competitors. In contrast, Hotel B shows a more scattered distribution, with many points below the line, indicating inconsistent occupancy performance.

Thanks to precise demand tracking through causal AI, Hotel A consistently sells more rooms at higher rates than the competitor using conventional forecasting.

Boosting RevPAR

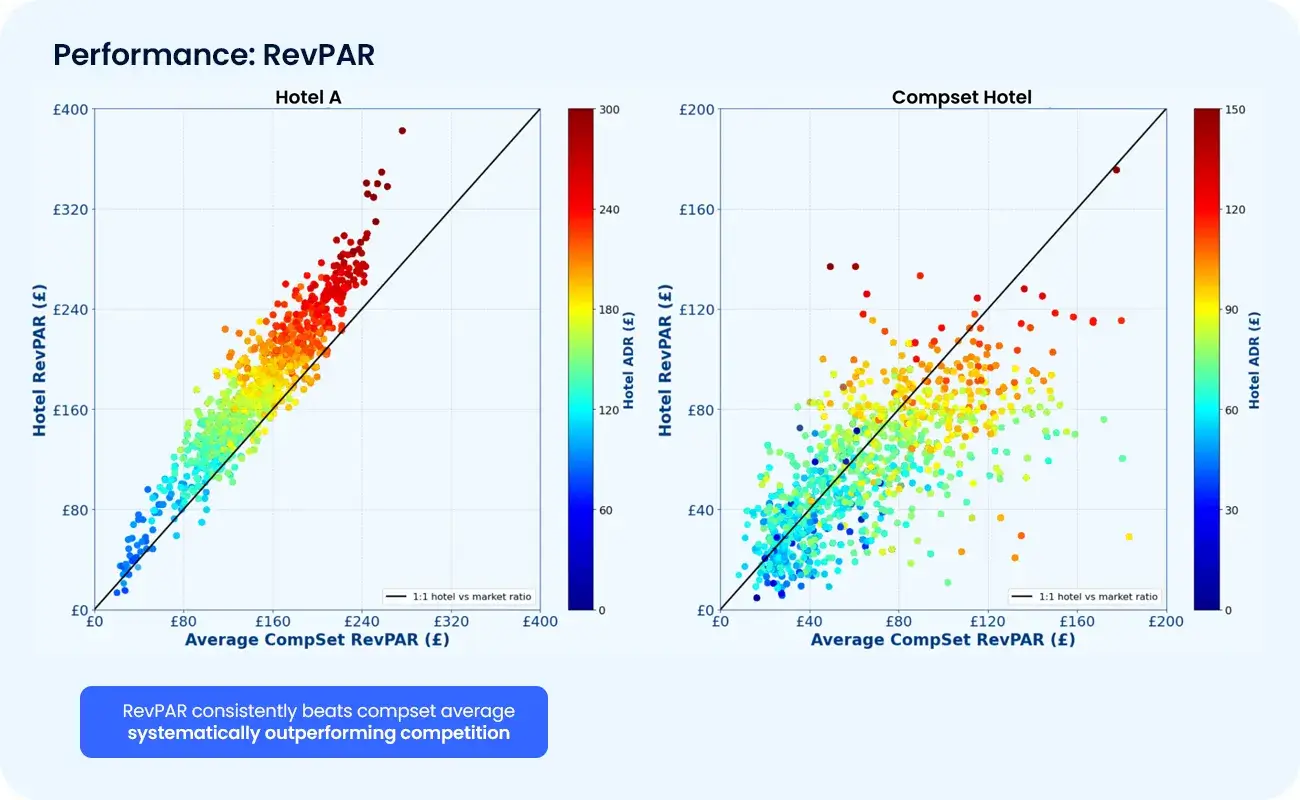

This second chart focuses on RevPAR (revenue per available room) rather than occupancy.

Here, the bold line represents the compset’s average RevPAR. Points above the line show days when the hotel’s RevPAR outperforms the compset, while points below indicate underperformance.

In this RevPAR chart, Hotel A again shows a strong cluster of points above the line, particularly in the upper right quadrant, indicating that it frequently achieves higher RevPAR than its competitors. In contrast, Hotel B (right) has a more dispersed spread of points, with many below the line.

This reflects less consistent RevPAR performance, indicating that the hotel struggles to maintain high revenue levels. The causal AI used by Hotel A allows it to optimize both occupancy and rates effectively, leading to sustained superior RevPAR results.

Turning forecasts into revenue with Cloudbeds

Forecast accuracy is only powerful if it leads to action.

That’s where Cloudbeds Revenue Intelligence comes in. It takes those Signals-powered forecasts and turns them into daily informed decisions for your team.

To see how it works in practice, check out Jonathan Singer, Customer Success Manager at Cloudbeds, walk through the three core feature sets of Cloudbeds Revenue Intelligence.

Explore the full masterclass.

See how to turn forecasting into real revenue decisions.

Inside Cloudbeds Revenue Intelligence, hoteliers get:

- An opportunities view with a full 365-day calendar of prioritized rate recommendations

- Built-in rate shopping, so you can see your comp set in context

- Analytics dashboards that combine actuals, forecasts, metrics, pickup, and segmentation in one place

- Email and marketing recommendations that turn need periods into targeted marketing campaigns in a few clicks

You can accept recommendations manually or flip on autopilot to let the system update rates every hour within the guardrails you set, to streamline your dynamic pricing strategy.

Instead of juggling spreadsheets, dashboards, and gut feel, your team sees one connected picture of demand, pricing, and marketing – and what to do next.

See forecasting the way it should be.

Discover how Cloudbeds turns signals into smarter pricing and stronger demand.